This MarketEYE article covers the global market for medical devices as described by the United States Food and Drug Administration (FDA) and the materials and electronic components that support them. We estimate the medical technology market, or MedTech market, at USD $586 billion worldwide – which includes $196 billion in medical electronic devices and $390 billion in medical materials.

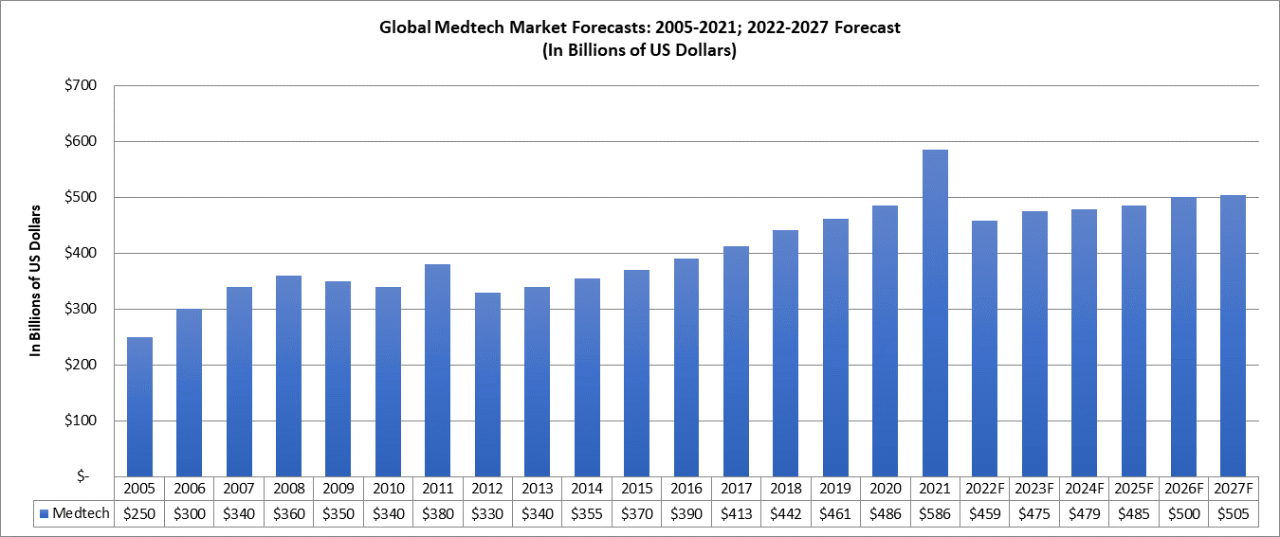

The following chart (Figure 1) illustrates the growth in the worldwide MedTech market between 2005 and 2021 when the market grew from $250 billion in value to $586 billion in value, which represents an aberration brought about by the pandemic, with a $75 billion global injection of value into the supply chain in 2021 in the form of fees for the development of a vaccination.

Meanwhile, other materials markets, especially for over-the-counter pain relievers and flu medicines increased by 16 percent year-on-year worldwide; as did electronic devices and medical materials related to oncology, which grew 12 percent in 2021 year-on-year; and materials and devices related to ulcer treatments and nervous disorders, each of which grew by 7 percent year-on-year in worldwide revenues for 2021.

Directly related to the increase in materials and devices related to oncology is the increase in sales of medical test and scan equipment, which saw a spike in demand as well.

Pre-Pandemic Growth

The dual engine that increased growth in MedTech from 2005 to 2008 and steady state growth from 2012 to 2018 is the combination of an aging population in Western markets and the support of emerging economies (Brazil, Russia, India and China). For 2019, 2020 and 2021, the market reacted to the global pandemic with a spurt of market activity in 2019, followed by a market pullback in 2020 and growth again in 2021.

The forecast is for the global MedTech market to return to its pre-pandemic growth cycle with significant lessons about stress-related illnesses and use those lessons to ensure green bond investing through corporate ethics, sustainability and governance.

The global pandemic injected an additional $7 billion in revenues into the materials segment in 2019, $30 billion in 2020 and $83 billion in 2021, with $75 billion of that going to vaccine and the balance going largely to pain relievers.

A substantial amount of global market activity in the space was noted in the December 2021 quarter, which experienced the pandemic variant event. This created a massive increase in medical materials sales in Europe in the quarter and also resulted in double digit sales in Asia and high, single-digit sales increases in the Americas.

Figure 1: Global MedTech Market Growth and Forecast to 2027

Source: “MLCC in Medical Test & Scan Equipment: 2021-2026 World Market Outlook” by Dennis Zogbi; Paumanok Publications, Inc. Estimates in billions of dollars (USD)

Medical Materials Versus Electronics

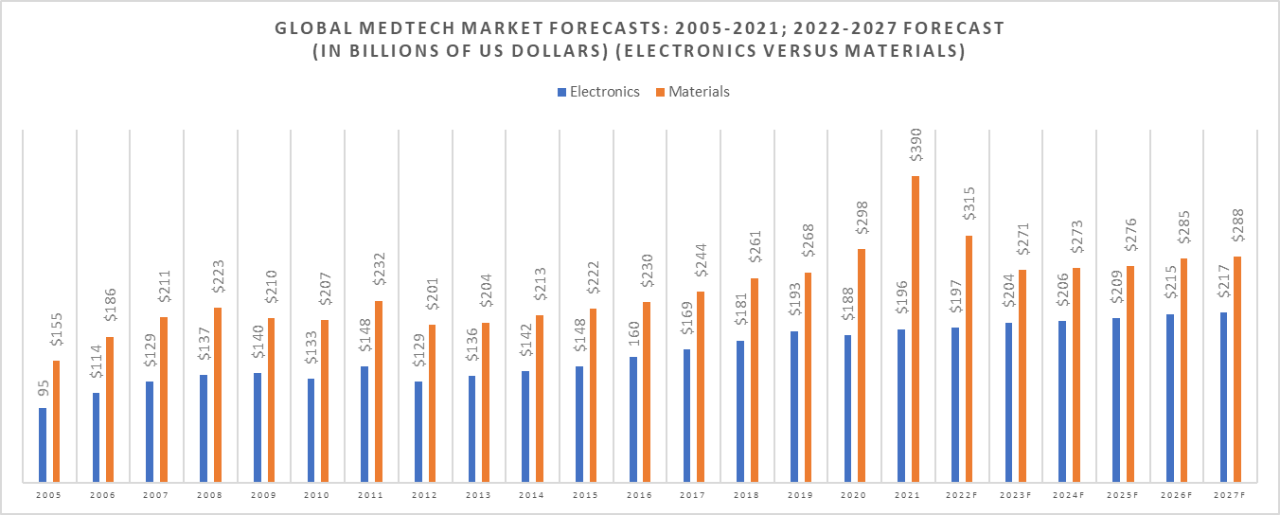

The following table (Figure 2) separates out the electronics segment of the global MedTech market for 2021 and illustrates how the market has changed since 2005, with both market segments showing different growth rates.

This supports the case for the market to grow in a similar manner to 2027 because the fundamental drivers behind historical growth have not changed. We also believe that electronics may give the growth rate an added boost of 5 percent per year on an average annual rate in revenues over the next five years as more people take medical matters into their own hands.

Medical device sales, which consume large quantities of passive components and for which capacitors are an enabling technology, are aggregated into cardiac and related implants, medical test and scan equipment, and pumps and compressor electronics.

Electronic component technical requirements for medical implants and medical scanning equipment are among the toughest in the world. Demand for medical electronic devices grew sharply in 2019 to $193 billion but then declined to $188 billion in 2020 and re-surged again in 2021 to $196 billion. We forecast this segment of the market to grow to $217 billion by 2027 and will consume many high frequency, high voltage and high reliability electronic components.

Figure 2: Global MedTech Market Growth by Type (Electronics vs. Materials), 2005-2021 + 2022-2027 Forecast

Source: “MLCC in Medical Test & Scan Equipment: 2021-2026 World Market Outlook” by Dennis Zogbi; Paumanok Publications, Inc. Estimates in billions of dollars (USD)

MedTech Electronics Markets By FDA Class Designation: Classes I, II and III

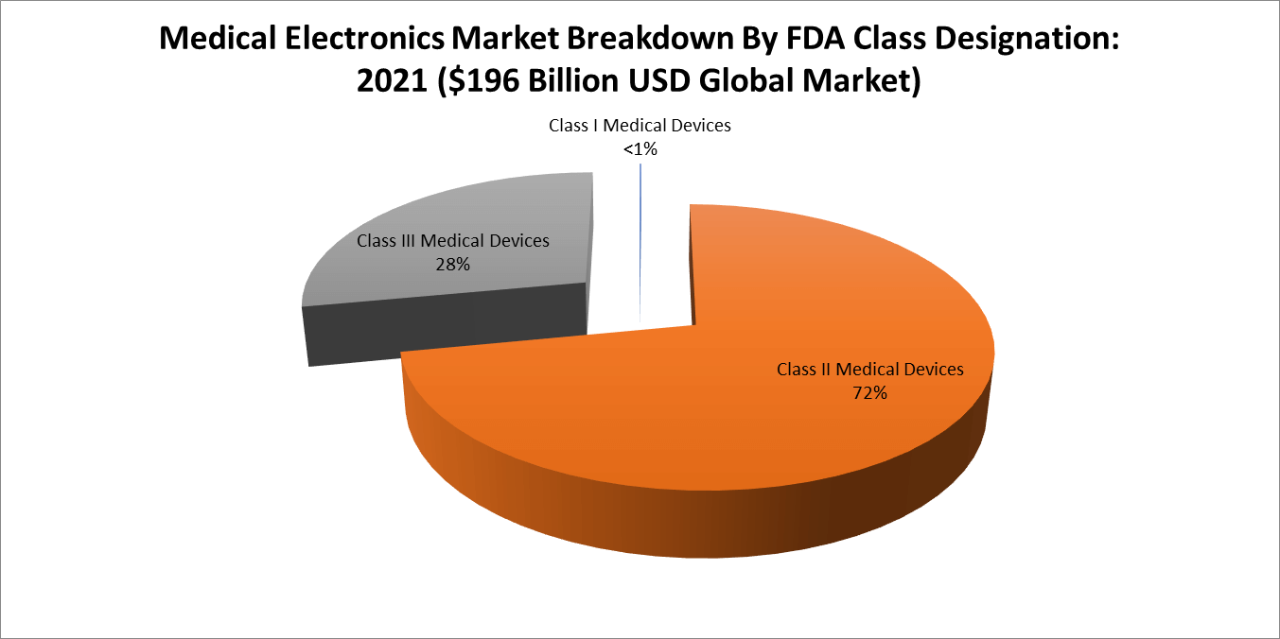

The FDA breaks down medical devices into granular sub-categories that include three sub-classes, with Class I having little or no electronic content, Class II having the most electronic content and Class III having the most valuable and mission critical electronic content.

Class I Medical Electronics Markets – Class I medical electronic markets are (based upon our estimates) 99.9 percent materials-based, and there are no electronics present in the FDA description of these very harmless devices, such as bandages. This segment of the materials market is so enormous that it represents a significant market opportunity for electronics, which is why companies like Johnson & Johnson (who had been traditionally a materials supplier) are now looking toward the consumables electronics markets, because they have the channels of distribution to exploit such a change.

Class II Medical Electronics Markets – This is where the majority of medical electronics and high-reliability electronic components (such as capacitors, resistors, inductors and circuit protection devices) are consumed in MedTech – 72 percent of the value. It is in FDA Class II electronics where we find the enormous medical test and scan equipment markets, which are all crammed into the radiology sub-segment, but also into multiple other minor sub-segments including pumps and compressors, chemical test and laboratory test equipment.

Class III Medical Electronics Markets – Class III medical devices are hard to get approved because they go inside the human body. It is such a narrow field of expertise, now largely known as cardiovascular electronics because so many products are under its umbrella. But for electronics – especially batteries, capacitors, resistors and inductors – we see a significant market in dollar value associated with cardio-implantable defibrillators. Twenty-eight percent of all component value is in Class III medical devices for pulse discharge and feedthru-type circuits. Class III medical electronics require the largest the largest amount of technical prowess and advanced component testing capability.

Figure 3: Medical Electronics Market Breakdown by FDA Class Designation: 2021

Source: “MLCC in Medical Test & Scan Equipment: 2021-2026 World Market Outlook” by Dennis Zogbi; Paumanok Publications, Inc. Estimates in billions of dollars (USD)

Total Available MedTech Market and Future Market Potential

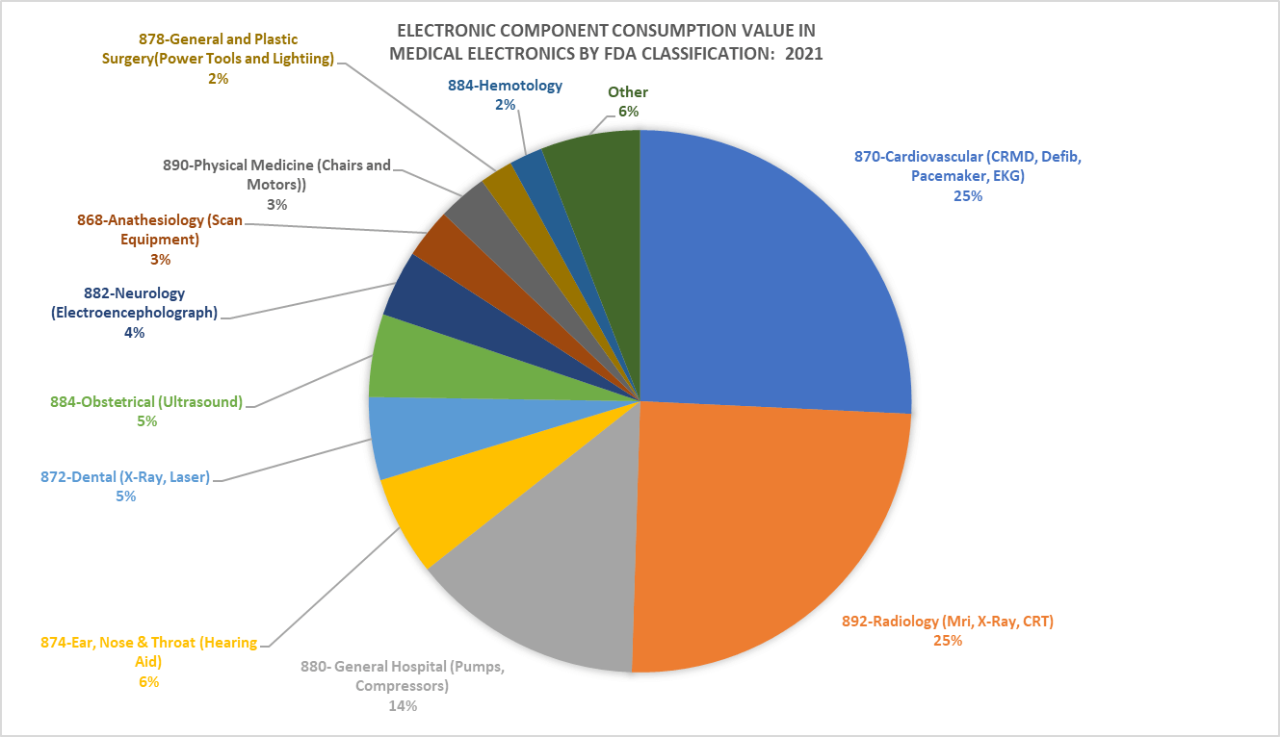

The following chart (Figure 4) illustrates the estimated market share in dollar value for electronics products by FDA sub-category in FDA approved Medical Devices. The chart supports that cardiovascular, radiology and general hospital categories are the major consumers of electronics (i.e. for implants, test and scan and pumps and compressors). The remaining categories are largely materials based (reagents) but show the large categories of new markets for electronics.

Johnson & Johnson estimates the consumable electronics markets are already at more than $15 billion in value, with markets such as glucose monitoring comprising a significant portion of new market consumption, and riding on a sentiment that it is better for consumers to aid in their own health through technology.

Penetration Of Capacitors into Class I, II and III Medical Devices

The market potential for electronic components in MedTech is substantial because of the aging populations in industrialized zones, growth potential in emerging economies and the movement to put health in the hands of the patient (consumables) and the opportunity to apply electronic devices to markets where electronics have not existed before in medicine – such as robotics and motors.

Since 2017, when we previously looked at this segment in depth, we see that the sales of CorMedix and related devices largely remained unchanged through the pandemic, while sales of large scale medical test and scan equipment increased at a rate that exceeded forecasts due to a rise in oncology-related equipment and materials between 2019 and 2021.

Figure 4: Electronic Component Consumption Value in Class I, II and III MedTech Devices, 2021

Consumption of Capacitors In Medical Devices, by Dielectric

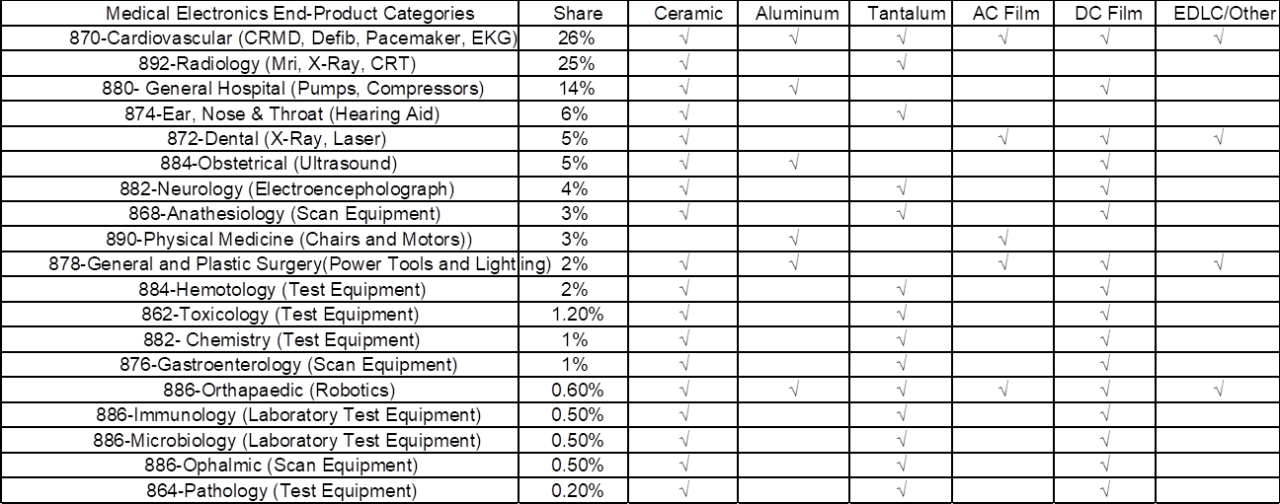

The following chart illustrates capacitor consumption by end-use product market in medical electronics and the types of capacitor dielectrics consumed. We note a significant market for ceramic capacitors, DC film capacitors and tantalum capacitors, as well as lucrative niche segments for aluminum capacitors (flash) and AC film (pulse).

Figure 5: Global Consumption Value for Capacitors by Dielectric in Medical Devices, 2021

Source: “MLCC in Medical Test & Scan Equipment: 2021-2026 World Market Outlook” by Dennis Zogbi; Paumanok Publications, Inc. Estimates in billions of dollars (USD)

Future Market Potential: 2023-2027

The global MedTech market performed in a matter that was consistent with other high-tech segments, including handsets and automobiles, which saw their markets decline in 2020 and re-emerge again in 2021. The impact of a shortage of semiconductors impacted the handset and automobile end-use market segments in 2021 by a loss of $300 billion. The medical markets, on the other hand, increased sharply in 2019, declined in 2020 and increased again in 2021, retaining their integrity of value worldwide and not fluctuating as much as other segments.

A detailed analysis of opportunities in medical electronics equipment reveals the following market opportunities which should gain traction beginning in 2023 and grow steadily through 2027. A blockchain analysis of passive components for these emerging product supply ecosystems reveals that, technically speaking, demand will be for parts that demonstrate high frequency, high voltage and high reliability performance in increasingly smaller chip case sizes.

There is also a keen focus of technology and finance on the development of burst power electronics for implants. Key product technologies will be in robotic assist, personal medical devices; implants and continued advances in medical imaging technology, which continues to be at the forefront of technological innovation.

Material in this article is adapted from “MLCC in Medical Test & Scan Equipment: 2021-2026 World Market Outlook” by Dennis Zogbi; Paumanok Publications, Inc.

Follow TTI, Inc. on LinkedIn for more news and market insights.

Statements of fact and opinions expressed in posts by contributors are the responsibility of the authors alone and do not imply an opinion of the officers or the representatives of TTI, Inc. or the TTI Family of Specialists.