Safety capacitors are a value-added subsegment of the multi-billion global capacitor industry, used in line voltage electronics both to reduce radio frequency and electromagnetic interference and to ensure consumer safety from shock and fire. In addition to filtering out noise interference in an electrical product or appliance, they are also used in these devices to help prevent noise interference from impacting adjacent circuits and systems.

A “safety capacitor” designation requires certification to ensure the capacitor’s performance under excessive operating conditions, usually related to high-voltage circuits. Many countries require that safety capacitors be certified to nation-specific requirements in order for those parts to be sold within their borders. However, most countries rely exclusively on the IEC-60384-14 (which was updated in 2013 and is specific to safety capacitors), as well as the UL 1414 standard and the CSA C22.2 standards that govern safety capacitors. Their stamp of approval is required to compete in world markets.

X and Y Capacitor Market Sub-Categories

Safety capacitors are also further dichotomized into “X” and “Y” interference suppression capacitor categories:

- For X-type capacitors there are classes X1, X2 and X3

- For Y-type capacitors there are classes Y1, Y2, Y3 and Y4

The general rules of application for safety capacitors are a count of three safety capacitors (one X and two Y) consumed in power supplies, and two Y-type capacitors consumed in lighting ballasts. These applications support a multi-billion piece global market for safety capacitors each year. The majority of safety capacitors sold worldwide are X1 (impulse tested to 4,000 volts), X2 (tested to 2,500 V), Y1 (tested to 8,000 V) and Y2 (tested to 5,000 V).

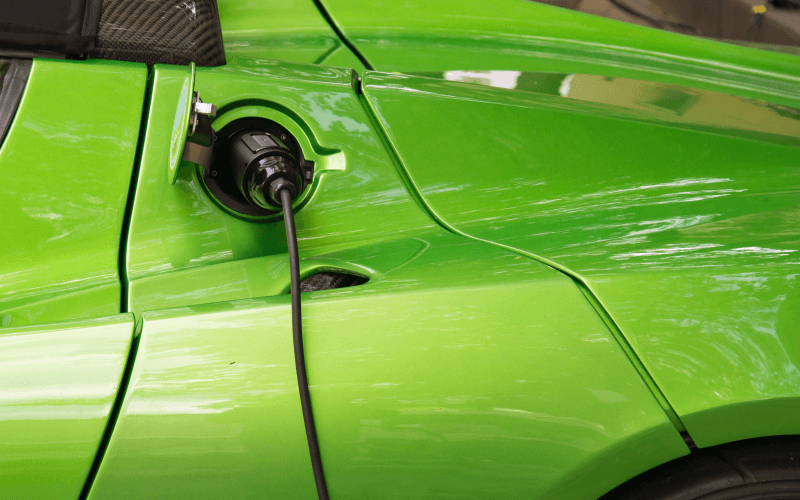

Types X2 and Y2 are the most popular interference suppression-type capacitors protecting line voltage equipment. X2 and Y2 safety capacitors are used primarily in appliances that plug into ordinary household wall outlets, while type X1 and Y1 interference suppression capacitors are consumed in heavy-duty industrial circuits and in battery electric vehicle charger systems – an end-market that is expected to grow substantially over the next five years.

Safety Capacitor Types and Configurations

Safety capacitors include metallized polypropylene film dielectric and barium titanate ceramic dielectric materials in radial-leaded, axial-leaded and surface-mount configurations. Radial-leaded ceramic disc capacitors compete directly against plastic film radial-leaded capacitors to occupy the board space for safety filtering (RFI and EMI protection).

Surface mount versions of safety capacitors are newer to the market. These are generally multilayered ceramic in configuration with lower costs to produce, but there is a limited supply base of certified vendors.

Dielectric film safety capacitors are still largely radial-leaded in design, but we also note a surface mount film chip capacitor used for interference suppression application as well. Competition between the two capacitor types (ceramic versus plastic film) is intense, and price sensitivity between the two competitive dielectrics is keen.

Film capacitors employ polypropylene as the active dielectric for safety capacitor applications, and ceramics employ typically NPO or X7R composition ceramic dielectrics for this component series.

Safety Capacitor Applications in the Market

Major market segments for safety capacitors continue to be in power supplies, lighting ballasts, AC power adapter, automotive DC motor applications, smoke detectors and other line voltage equipment.

As these markets moved to China and southeast Asia over time, there has been greater emphasis upon component cost reduction, which in some instances means a movement away from the more stable DC film versions to the lower-cost ceramic safety capacitors.

Market Structure for Safety Capacitors

Major markets for safety capacitor consumption exist in Asia, with the largest markets being China, Korea and Japan which require between 400 million and 1 billion pieces (China) in each country. In Europe, the two largest markets remain Germany and Italy (100 to 200 million pieces). The USA/Mexico region requires a collective 100 million pieces.

Future directions suggest continued unit growth in demand for safety capacitors consumed in line voltage equipment, especially to protect devices connected to the Internet of Things (IoT). But what is expected to truly create value-added growth in the industry is demand coming from the battery electric vehicle market, which requires multiple high voltage X and Y safety capacitors for interference suppression in charger related circuits.

Safety Capacitors in Battery Electric Vehicles

The market for safety capacitors in battery electric vehicles is expected to quadruple in six years for applications in the onboard charger. Since film capacitors are not used in large volumes in fossil fuel electronics, the opportunities in EVx propulsion for X and Y capacitors represents a net new market for film capacitor manufacturers that has not existed in prior years.

Due to the limited number of vendors of safety capacitors to begin with, manufacturers are looking for vendors who supply traditional line voltage electronics but who have not ventured into the automotive segment in the past.

We note many different interference suppression capacitors being consumed in onboard charger circuits for battery electric vehicles, but not all the products being consumed are AECQ200 qualified for use in a harsh automotive environment. These onboard charging circuits employ capacitors for suppression of radio frequency interference (RFI) and electromagnetic interference (EMI). All of the designs evaluated were metallized polypropylene dielectric in a radial leaded box type configuration and rated from 105 degrees C to 125 C, with high voltage variations and low capacitance signatures in the low microfarad range (less than 18 microfarads).

The number of X and Y capacitors consumed per circuit depends upon the voltage of each individual cell and the architecture of the battery electric vehicle (usually at 375 V as in a Tesla Model 3, but with new platforms this is as high as 800 V in the new Porsche). This requires the use of multiple capacitors in parallel and series per car. Individual capacitor voltages for the OBC circuits are noted at 250 V, 310 V, 630 V, 1,000 V and 1,500 V.

Our Paumanok Publications, Inc. report notes the use of Y2/X1 and many X2 configurations for the OBC circuits. Similar requirements are noted for the charging stations, making this a significant growth opportunity for X and Y safety capacitor manufacturers over the next five years and beyond.

Ceramic safety capacitors are also consumed in battery electric vehicles in onboard charging and wireless charging circuits, where they compete directly with plastic film capacitors on price and performance. We note that many of the ceramic capacitors consumed in battery electric vehicles are single-layer ceramic discs which are large diameter products designed to handle these high voltages.

We also note that single layer ceramic discs are sold for interference suppression in X1, X2 and Y2/X1 configurations for EMI and RFI suppression. Safety capacitor requirements in battery management systems (250 VAC X1/X2 safety capacitors, MLCC format with polymer terminations) are almost exclusively ceramic because of the 125 C temperature requirement for the components – a temperature range that has, to date, excluded film dielectrics from participating.

Summary and Conclusions

Safety capacitors are manufactured from plastic film or ceramic dielectric, with the plastic film dielectric manufactured from polypropylene and the ceramic manufactured from barium titanate.

Plastic film capacitors consumed for interference suppression applications are usually radial leaded designs, while ceramic are usually single layered ceramic designs. Both products can handle high voltages. Both products are available in the low microfarad range and are designed to suppress radio frequency and electromagnetic interference.

Due to their application-specific nature, these components have high average unit selling prices and respectable profit margins.

Safety capacitor markets worldwide are expected to get a boost from the rapid deployment of battery electric vehicles, which are expected to grow in number from 1.23 million sedans in 2020 to 15 million by 2026.

Follow TTI, Inc. on LinkedIn for more news and market insights.

Statements of fact and opinions expressed in posts by contributors are the responsibility of the authors alone and do not imply an opinion of the officers or the representatives of TTI, Inc. or the TTI Family of Specialists.