There’s been a lot of conversation of late about supply chain risks in the wake of so many supply chain disruptions caused by COVID-19. Tens of thousands of companies around the world suffered some loss of supply continuity this spring and into the summer as waves of the pandemic rippled through global supply chain links from Aachen to Zapopen.

2020 was the starkest reminder in years of the inter-connectedness of global supply chains and how very fragile they can be. And although massive loss of supply continuity is a fresh wakeup call on the risks that all supply chains face, most supply chain risks are not so harshly binary.

Types of Supply Chain Risk

There are an almost immeasurable number of potential risks to supply chains, as grey-hair practitioners young and old can attest. But at the most fundamental level, most supply chain risks can generally be categorized into three overarching risks when considered from the point of view of their impacts. These categories can be summarized as the risks to the following:

- Economics of supply: This type of risk is not about the normal, de minimis fluctuations in the costs of raw material, components and labor. Risks to the economics of supply should focus on the possibility and probability of specific events, both systemic and idiosyncratic, that could have a “material adverse impact” on the cost of goods produced. Examples of risks to the economics of supply can include abrupt changes to the value of a foreign currency, loss of a primary mode of transportation or excessive reliance on a highly-constrained raw material, etc.

- Quality of supply: Significant changes in the quality of supply can have a multiplicative impact on finished goods production, depending on the nature of the quality issue and where the problem arises in the value stream. Sudden changes in supply quality can be caused by disruptive labor actions, upstream changes to raw material or raw material sources, insufficient alternative supplier qualification, etc.

- Continuity of supply: A significant decline in the availability of supply from the previous state. Consistent with the primary conversation in the industry today, this article will focus on defining and measuring the primary risk to continuity of supply.

Of course, continuity and economics can never be fully decoupled, so for our purposes, we will define “continuity of supply” as “the ability to continue to obtain the desired goods, with minimal disruption, at a reasonably consistent price.”

Risk Factors Impacting Continuity of Supply

With all the talk today about building more resilient supply chains, it is important to recognize here that supply chain resilience is not the perfect antipode of supply chain risk, although they obviously exhibit a strong negative correlation to each other. The more resilient the supply chain design, the lower the risk – especially the risk to continuity of supply.

There are innumerable sources of potential risk that can impact supply continuity, ranging from the mundane to the highly improbable. In general, the primary sources of supply chain risk can be group into one of the categories listed below:

Source concentration – The extent to which raw materials, conversion activities, process equipment, etc. is single sourced, sole sourced or sourced with a high level of geographic concentration. Source concentration is not a major source of risk for widely-produced commercial off-the-shelf (COTS) parts, although it generally presents the greatest risk to custom and made-to-spec parts.

Lead times – The lead time for raw material, conversion activities and even the process/test equipment used to produce the components, along with the variability of these lead times, is a major source of supply continuity risk. This is obviously most problematic when component and raw material lead times exceed demand visibility for the finished product or the manufacturing planning horizon for that product. Instances where lead times for key material suddenly lengthen and move from within the planning horizon to well beyond the current planning horizon are a particularly acute source of risk.

Obsolescence – With device life cycles getting shorter, certain types of products are at increasing risk of disruptions to supply caused by component obsolescence, or decreased production volumes in anticipation of obsolescence. The risk of obsolescence is often seen in far upstream raw materials as increasing environmental regulations make some material too costly or even illegal to produce.

Scalability – Understanding and quantifying what it takes to scale up output is critical to ensuring supply chain continuity. When the lead time required to scale up the volume of material or components is dramatically longer than your own demand visibility or planning horizon, scalability risk can be hard to foresee unless it is specifically being monitored and managed. This type of risk is particularly problematic when your firm, or the aggregate demand of many firms, approaches a supplier’s total capacity for a specific part.

Geopolitical risk – Understanding the risks associated with government actions and regulations at key points in the supply chain is worth some attention in today’s highly globalized supply chains. Geopolitical risks include bans on exports from producing countries and bans on imports for consuming countries. Other risks in this category include targeted administrative slowdowns in export approvals, such as what we saw in July of 2019 when Japan took unilateral action to intentionally slow exports of the key semiconductor photoresist material fluorinated polyimide to Korea, sending shockwaves through the DRAM and Flash markets.

Natural disasters – As global climate change contributes to more frequent cases of severe weather, the risks that natural disasters will impact parts of the supply chain are increasing at a nearly exponential rate. Natural disasters not linked to climate change, such as earthquakes, tsunamis and volcanoes, can (and have, in recent memory) severely impacted tech supply chains.

Legal – Although these disruptions are few and far between, they can have a devastating impact downstream in the supply chain. Raw materials and components designed or produced with proprietary technology that is currently under some legal dispute, or which have a pedigree that makes a legal dispute likely, are an almost totally overlooked source of risk. Component shipments and even the production of components can be impacted by a legal settlement, or worse, temporarily halted as a means of providing injunctive relief for the aggrieved party. Additionally, courts around the world have occasionally ordered production halts, or even full plant closures, in response to everything from labor unrest to environmental infractions to unsafe working conditions.

Developing a Measure of Supply Chain Risk

As mentioned in my previous article on supply chain resiliency, the two key obstacles that prevent companies from developing more resilient supply chains are the inability to quantify specific risks and uncertainty around the potential impact of a specific risk event should it occur.

For the purpose of this article, let’s label these as:

PR = The probability of a specific risk event, and

IR = The impact of a specific risk event

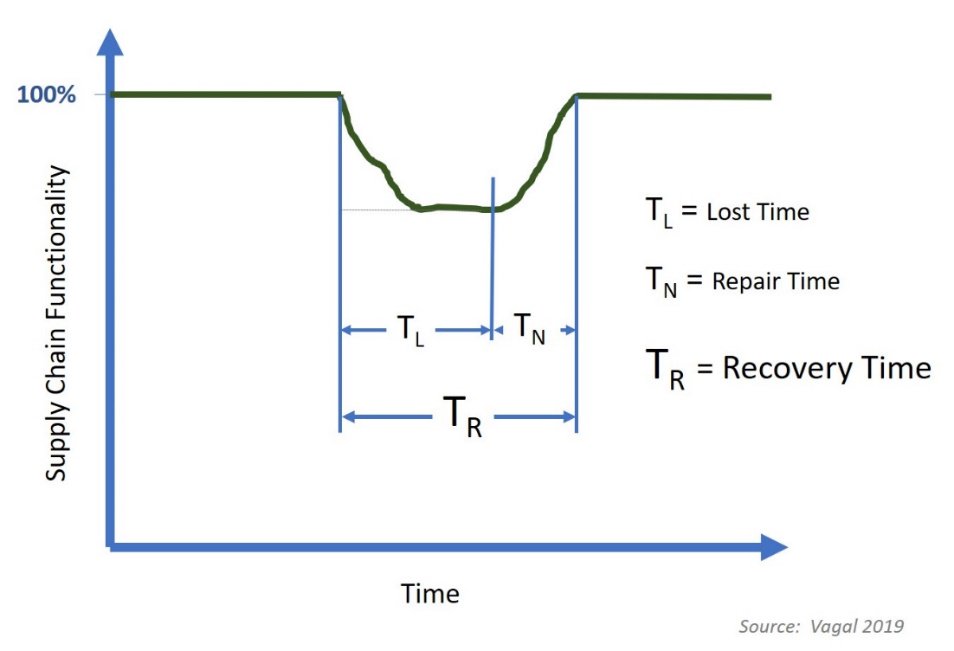

Also covered in the previous article was recovery time, which is defined as the total time an impacted supply chain takes to get back to its nominal, pre-event output. From the previous article we have the definition of recovery time as:

TR = Recovery Time, which is the sum of TL, = Lost time and TN = Repair time

Recovery time is best explained graphically, as shown in the figure below:

The challenges associated with quantifying supply chain risks and their expected impact notwithstanding, it logically follows from the previous arguments that a good measure of supply chain risk could loosely be defined as:

Supply Chain Risk = (Probability of Risk) x (Impact of Risk) x (Recovery Time)

RSC = (RP) x (RI) x (TR)

So, to develop a quantitative measure of supply chain risk, we need to determine or establish specific values for the three variables shown in the formula above. Determining appropriate values for these variables for each of the seven risk categories elaborated above, assigned across all of your key components and materials, and for each of your key vendors, provides a pretty powerful Supply Chain Risk Scorecard (SCRS).

A Painstaking Process

As daunting and time consuming as this endeavor might seem, it is undoubtedly a case where the perfect cannot be allowed to be the enemy of the good. Assigning values to these variables can involve elaborate, painstaking and costly research and analysis, or it can be made far less cumbersome by using a combination of thoughtful estimates and well-constructed proxies for each number assigned.

As so many of these probabilities and impacts are either probabilistic and/or not precisely knowable, thoughtful estimates may provide just as good of a result as more costly and intensive efforts are quantifying supply chain risks.

In part two of this article, we will use the information from above to construct a Supply Chain Risk Scorecard (SCRS) to quantify these risks and prioritize risk reduction efforts in the supply chain.

Statements of fact and opinions expressed in posts by contributors are the responsibility of the authors alone and do not imply an opinion of the officers or the representatives of TTI, Inc. or the TTI Family of Companies.